German Inheritance Tax applies when British Legators (and their Lawyers) least expect it

UK and US lawyers are used to an inheritance tax regime where (only) the estate as such is being taxed. Within that system, it does not matter too much who the beneficiary is and where he or she is domiciled.

The German Inheritance Tax concept, however, works entirely differently (basics explained here). Instead of taxing the estate itself, it taxes each individual beneficiary. However, if that beneficiary is domiciled outside of Germany, the German IHT code also taxes the estate. In other words, to a British lawyer, German IHT does apply in surprisingly many circumstances, namely:

- (i) the deceased has been resident in Germany (domicile is not required, simple residency triggers German IHT); or

- (ii) the beneficiary is resident in Germany; or

- (iii) certain assets (specifically defined by German tax law) are located within Germany (details are explained below).

An everyday example, which very often leads to unpleasant surprises is this: The English testator has his entire estate within the UK and sets up an English Will in which the testator gives a legacy of say GBP 50,000 to a friend or relative who lives in Germany. From a UK perspective, the estate is subject to UK Inheritance Tax. End of story. However, English solicitors often forget that the beneficiary in Germany is also subject to German inheritance tax. If the Will says that the gift is “free of IHT” the dispute begins whether the testator really intended that the German tax shall also be paid by the estate (on top of the UK IHT).

And this is only a very simple example. Most cases we deal with are much more complex and involve various layers of taxation plus the matter of whether taxes paid in one country can be set off against taxes due in another.

For those who wish to examine the German Inheritance and Gift Tax Code in more detail, let me explain section 2 of the German IHT Code, which distinguishes between two situations: (i) legator / donor or beneficiary is resident in Germany or (ii) neither legator /donor nor beneficiary is resident in Germany:

(i) Resident in Germany

According to sec. 2 para. 1, lit. 1a and lit. 1b Erbschafts- und Schenkungssteuergesetz / German Inheritance and Gift Tax Code, someone who has any kind of residence (Wohnsitz) in Germany, is qualified as “Steuer-Inländer” (i.e. German Tax Resident), which means that:

If the Steuer-Inländer dies, all his/her global assets are subject to German IHT (unbeschränkte Steuerpflicht, i.e. unlimited IHT liability). In this case, the German tax authorities will base their calculation of German IHT on the entire global estate.

If the Steuer-Inländer is a beneficiary (i.e. a donee, heir or a legatee), everything that person receives (not just the German assets) is subject to German IHT.

(ii) Not resident in Germany

If neither the donor nor the recipient are resident in Germany, then according to sec. 2 para. 1, lit. 3 Erbschafts- und Schenkungssteuergesetz / German Inheritance and Gift Tax Code German IHT does apply in regard to those assets which are defined as „Inlandsvermögen“ pursuant to section 121 Bewertungsgesetzes, these cases are called “beschränkte Steuerpflicht”.

Acording to sec. 121 Bewertungsgesetz (here), property and other certain investments fall into this category of Inlandsvermögen (national assets) and are thus subject to German IHT.

In other words: German IHT will always be due on German property and the other investments listed in the Bewertungsgesetz, regardless of whether donor or beneficiary were / are resident here or not.

Still, the issue of whether a person has a residence in Germany is extremely important, especially if the estate contains (i) pure monetary investments in Germany and/or (ii) significant assets (of whatever kind) outside of Germany.

Whether and how much tax will actually be due depends on the individual tax exemptions available to the beneficiaries, see sec. 16 ErbStG (here).

What makes the taxation of German assets for non-residents even more dangerous is the fact that the donor or the beneficiary is qualified as an IHT non-tax-resident, the German IHT code only grants the German estate a restricted allowance. The German IHT allowance is only granted pro rata.

This is a huge disadvantage to the normal personal inheritance tax allowances of EUR 500,000 for the spouse, EUR 400,000 per child and EUR 200,000 per grandchild. Thus, in some cases, it may be the wiser choice to actively opt to be treated as an Steuer-Inländer (German tax resident), because then the full personal allowances become available. Such a right to opt is available in certain circumstances, see sec. 16 ERbStG. However, this choice only makes sense if (i) the beneficiary is a close relative and thus has high personal allowances and (ii) the non-German assets do not outweigh the German assets, because opting to be treated as German tax resident of course also means, that all global assets are subject to German IHT.

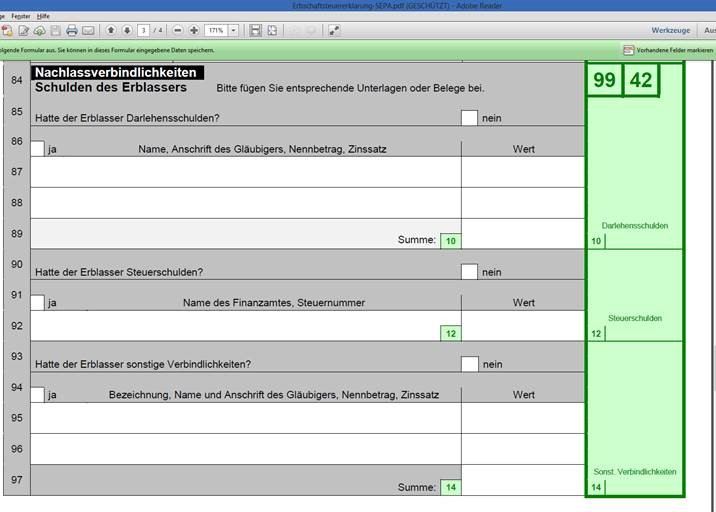

UK residents with property or IHT relevant investments in Germany should therefore get professional tax advice if they want to avoid their assets being double taxed by German and British tax authorities. The simple trick of mortgaging the German property is usually not helpful, because German tax authorities will not accept a mere mortgage notice in the German Land Registry (Grundbuch, details here). They will want to see evidence whether the mortgage – which could be an empty shell – is backed by an actual obligation towards a third party, i.e. they will want to be provided proof of loan agreeements, statements or even affidavits from the lender etc. Here is an extract from the main German IHT form (Erbschaftssteuerformular) which the beneficiaries have to fill in and submit. The full German inheritance tax forms are available for download here.

As you can see from lines 84 of the form onward, the German tax office demands the names and address of creditors and lenders, and they want to see copies of the actual loan agreements “Bitte fügen Sie entsprechende Belege bei”)

– – –

For more information on German-British probate matters and international will preparation see the below posts by the international succession law experts of Graf & Partners LLP:

- Efficient Transfer of Foreign Assets

- Most Germans die without a Will (German Intestacy Rules)

- Formal Requirements to set up a valid Will in England, Scotland and Germany: What are the Differences?

- The Perils of German IHT and Gift Tax

- Basics of German Inheritance and Succession Law

- Executors and Trustees in German Inheritance Law

- How to apply for a German Grant of Probate

- The Infamous German Community of Heirs – And how to avoid it

- International Wills and Estate Planning for British-German Families

- Prove German Wills for English Probate

- Disputed Wills and Contentious Probate in Germany

- Disinherit your no-good children? Not so easy in Germany

- Don’t be afraid of Clients with Foreign Assets!

- Can foreign Taxes be set off against UK Inheritance Tax?

Or simply click on the “German Probate” section in the right column of this blog.

– – –

In case you need specific advice in a concrete case or assistance in German probate procedures, feel free to contact the lawyers of the German firm Graf & Partners which are specialized in British-German succession issues. Attorney Bernhard Schmeilzl has years of experience acting as executor and administrator of estates, both in the UK and in Germany. He is an expert in international succesion law and gives lectures and seminars for UK probate solicitors and UK accountants who advise clients with foreign assets.

In case you need specific advice in a concrete case or assistance in German probate procedures, feel free to contact the lawyers of the German firm Graf & Partners which are specialized in British-German succession issues. Attorney Bernhard Schmeilzl has years of experience acting as executor and administrator of estates, both in the UK and in Germany. He is an expert in international succesion law and gives lectures and seminars for UK probate solicitors and UK accountants who advise clients with foreign assets.

– – –

The law firm Graf & Partners was established in 2003 and has many years of experience with British-German and US-German probate matters. If you wish us to advise or represent you in a German or cross border inheritance case please contact German solicitor Bernhard Schmeilzl, LL.M. (Leicester) at +49 941 463 7070.

[…] (nationality) and residency to determine where the (global) assets of the deceased shall be taxed (details here). Therefore, it may well happen that two countries claim national inheritance tax in regard to the […]

[…] German tax authorities do not look at the estate but at the individual beneficiaries. Their respective personal gain is taxed (for details, what circumstances trigger German Inheritance Taxes see here). […]

[…] example: An English testator owns property or a significant investment in Germany, which already triggers German inheritance tax, even if neither the legator nor the beneficiaries are resident in Germany. He has two children and […]

[…] The Perils of German IHT and Gift Tax […]

[…] If the Deceased held funds or owned property in Germany, the German Tax Office (Finanzamt) will find out about it and will – most likely – levy German inheritance tax, even if the deceased was not a German national and even if the deceased was not resident in Germany. We have explained the workings of the German Inheritance and Gift Tax Code (Erbschafts- und Schenkungssteuergesetz) here. […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] https://www.crosschannellawyers.co.uk/the-perils-of-german-inheritance-tax-and-gift-tax/ […]

[…] The Perils of German Inheritance Tax and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]

[…] The Perils of German IHT and Gift Tax […]