The first practical step when applying for an Austrian Grant of Probate is completing the Todesfallaufnahme questionnaire

In the previous posts How to Access Assets in Austria? and How to deal with Assets in Austria we have already explained the relevant Austrian succession laws and probate regulations. In this new post, we show what practical step needs to be taken in order to start the Austrian probate procedure.

Contact the competent Austrian probate court

Under the Austrian legal system, each succession case is dealt with by an Austrian notary who is appointed by the court as a so called “Gerichtskommissär” (i.e. commissioner of the Austrian probate court). This involvement of a probate court commissioner takes place regardless of whether the estate is dealt with by way of a “Verlassenschaftsverfahren” or by way of the simpler “Ausfolgungsverfahren” (the differences between the two are explained in the posts listed above).

Todesfallaufnahme Questionnaire

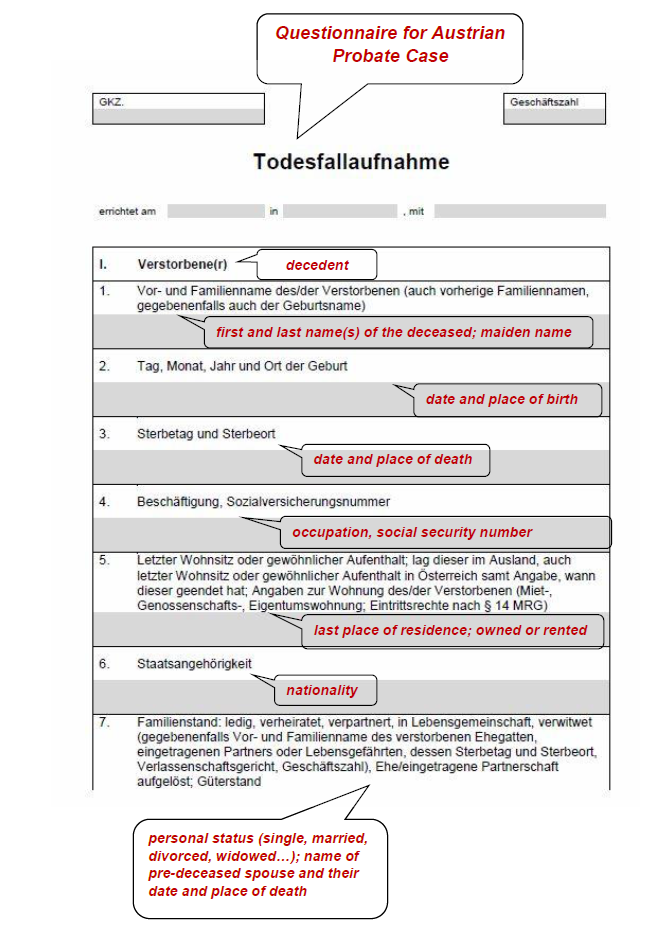

In each case, the parties to the Austrian probate procedure will be asked by the Gerichtskommissär to complete an extensive 5 page questionnaire which is called the “Todesfallaufnahme Formular” (questionnaire for Austrian probate cases). While each notary may use slightly different templates of said Todesfallaufnahme questionnaire, the questions therein are more or less identical. A typical form looks like the below. Since the official Austrian probate court form is obviously in German language, I have inserted English language comments which explain what information is requested by the Austrian notary. Here is page 1 of the questionnaire:

The full 5 page questionnaire can be downloaded as pdf here: Todesfallaufnahme Formular Muster kommentiert Englisch

For more information on Anglo-Austrian and Anglo-German probate matterssee the below posts by the international succession law experts of Graf & Partners LLP:

- Most Germans die without a Will (German Intestacy Rules)

- Formal Requirements to set up a valid Will in England, Scotland and Germany: What are the Differences?

- The Perils of German IHT and Gift Tax

- Careful with Deed of Variation if Estate comprises Foreign Assets

- Basics of German Inheritance and Succession Law

- Executors and Trustees in German Inheritance Law

- How to apply for a German Grant of Probate

- The Infamous German Community of Heirs – And how to avoid it

- Germans Heirs are Personally Liable for Debts of the Deceased

- International Wills and Estate Planning for British-German Families

- Prove German Wills for English Probate

- Disputed Wills and Contentious Probate in Germany

- Disinherit your no-good children? Not so easy in Germany

- Don’t be afraid of Clients with Foreign Assets!

- Can foreign Taxes be set off against UK Inheritance Tax?

Or simply enter “probate” or “inheritance” in the search box above.

The law firm Graf & Partners and its German-English litigation department GP Chambers was established in 2003 and has many years of experience with British-German and US-German probate matters, including the representation of clients in contentious probate matters. We are experts ininternational succession matters, probate and inheritance law, including international litigation. If you wish us to advise or represent you in a German or cross border inheritance case please contact German solicitor Bernhard Schmeilzl, LL.M. (Leicester) at +49 941 463 7070.