What is required to get German assets released to British or US-American executors or beneficiaries?

In order to get German assets released, the executors or beneficiaries must be able to provide the German banks or insurers with a German (or European) Grant of Probate – unless the testator has made the will in notarial form or the testator has granted a transmortal power of attorney. For more on how to access German assets without having to go through probate see this post.

What is often forgotten, however, is that in addition to the German grant of probate (Erbschein), the German banks will also ask to see a tax clearance certificate or “certificate of non objection”, in German called “Unbedenklichkeitsbescheinigung”. Without such German tax clearance letter from the German Finanzamt (tax office), the bank is not allowed to release the assets, especially not for a transfer abroad. More on the legal requirements regarding the release of foreign assets to foreign beneficiaries here.

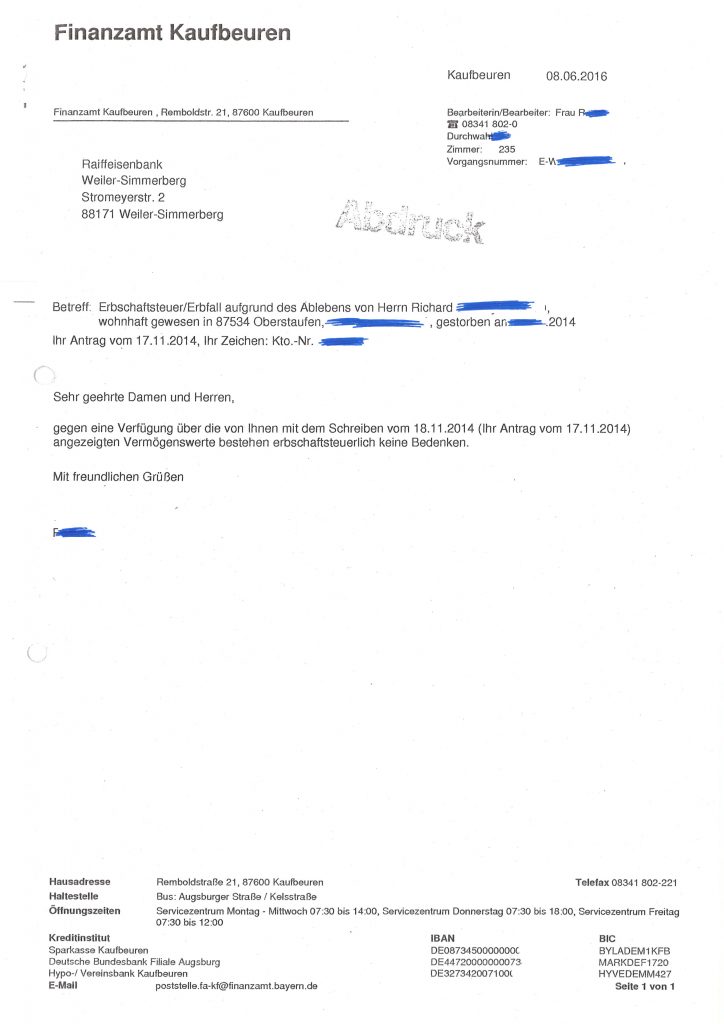

This is what a typical inheritance tax clearance confirmation letter issued by a German tax office (Finanzamt) looks like:

Usually, the German tax authorities send the tax clearance certificate directly to the respective bank to inform them about thefact that the monies may now be released to the executor or the beneficiaries.

The clearance certificate is issued by the local German tax office dealing with the inheritance, usually the city where the testator had his or her last Germany residence. To obtain the clearance certificate, the executor or the beneficiaries must submit the German IHT forms and pay any German inheritance tax due.

For more information on cross border probate matters, international will preparation and German inheritance tax matters see the below posts by the international succession law and tax law experts of German law firm Graf & Partners LLP:

- Brochure on German Probate and German Inheritance Tax (in English)

- Most Germans die without a Will (German Intestacy Rules)

- Formal Requirements to set up a valid Will in England, Scotland and Germany: What are the Differences?

- The Perils of German IHT and Gift Tax

- How to access German assets without going through Probate

- Careful with Deed of Variation if Estate comprises Foreign Assets

- Basics of German Inheritance and Succession Law

- Executors and Trustees in German Inheritance Law

- How to apply for a German Grant of Probate

- The Infamous German Community of Heirs – And how to avoid it

- Germans Heirs are Personally Liable for Debts of the Deceased

- International Wills and Estate Planning for British-German Families

- Prove German Wills for English Probate

- Disputed Wills and Contentious Probate in Germany

- Disinherit your no-good children? Not so easy in Germany

- Don’t be afraid of Clients with Foreign Assets!

- Can foreign Taxes be set off against UK Inheritance Tax?

Or simply click on the “German Probate” section in the right column of this blog.

– – – –

The Anglo-German law firm Graf & Partners and its German-English litigation department GP Chambers was established in 2003 and has many years of experience with British-German and US-German probate and tax matters, including the representation of clients in contentious probate matters. We are experts ininternational succession matters, probate and inheritance law. If you wish us to advise or represent you in a German or cross border inheritance case please contact German solicitor Bernhard Schmeilzl, LL.M. (Leicester) at +49 941 463 7070.

[…] erst ins Ausland überwiesen werden, nachdem der Erbe (oder Executor) der Bank die Unbedenklichkeitsbescheinigung (Tax Clearance Certificate) des deutschen Finanzamts vorlegen kann. Wohlgemerkt auch in Fällen, in denen gar keine deutsche […]

[…] German Tax Clearance Certificate (Inheritance Tax) […]

[…] German Tax Clearance Certificate (Inheritance Tax) […]

[…] Attempting to avoid German inheritance tax will not only be a criminal offense under German law, it will also not be successful, because no German bank, building soeciety, insurer or share fund will release any German assets until the German tax office (Finanzamt) has issued an official tax clearance (Unbedenklichkeitsbescheinigung), more on that here. […]