Where to download the official German Estate and Gift Tax Forms

If an estate comprises German assets or if a beneficiary to an estate is resident in Germany, then German inheritance tax (“Erbschaftsteuer”) must be paid. Depending on the circumstances of the case, this German estate tax is levied either on the entire global estate of the deceased or at least on the portion of the estate which was gifted to the beneficiary who is resident in Germany.

Attempting to avoid German inheritance tax will not only be a criminal offense under German law, it will also not be successful, because no German bank, building soeciety, insurer or share fund will release any German assets until the German tax office (Finanzamt) has issued an official tax clearance (Unbedenklichkeitsbescheinigung), more on that here.

Which German Estate Tax Forms to use and where to find them

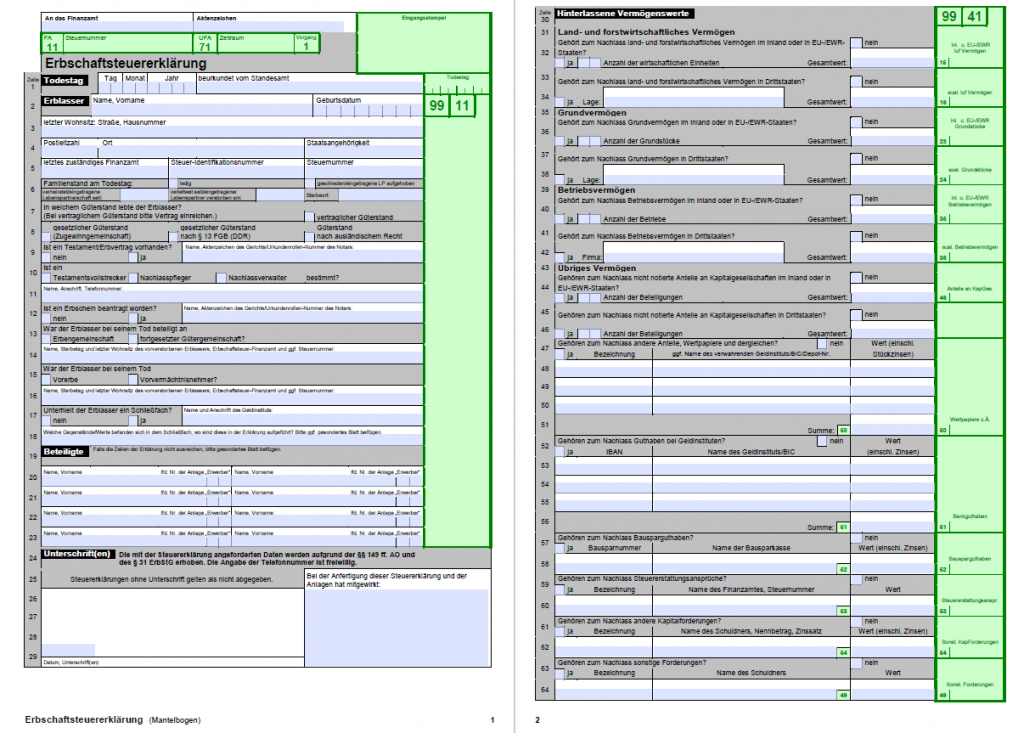

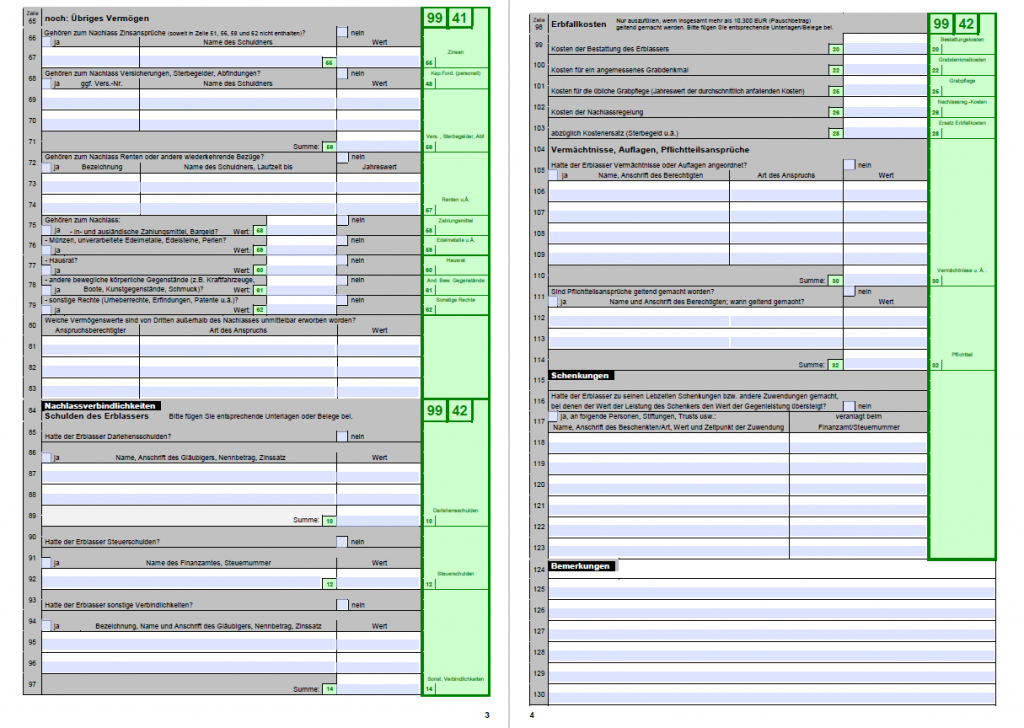

In order to obtain such a German tax clearance certificate, the executor or the German beneficiary (or both) need to file German estate tax forms (Erbschaftsteuererklärung) with the competent German estate tax authorities (Erbschaftsteuerfinanzamt). Since German inheritance tax law does not tax the estate itself (called the “Nachlass”) but each individual beneficiary (called “Erwerber”), there are various forms. The executor or, if there is no such executor, the German community of heirs jointly must submit the main form (“Mantelbogen”) which requests the personal data about the decedent as well as a complete estate inventory.

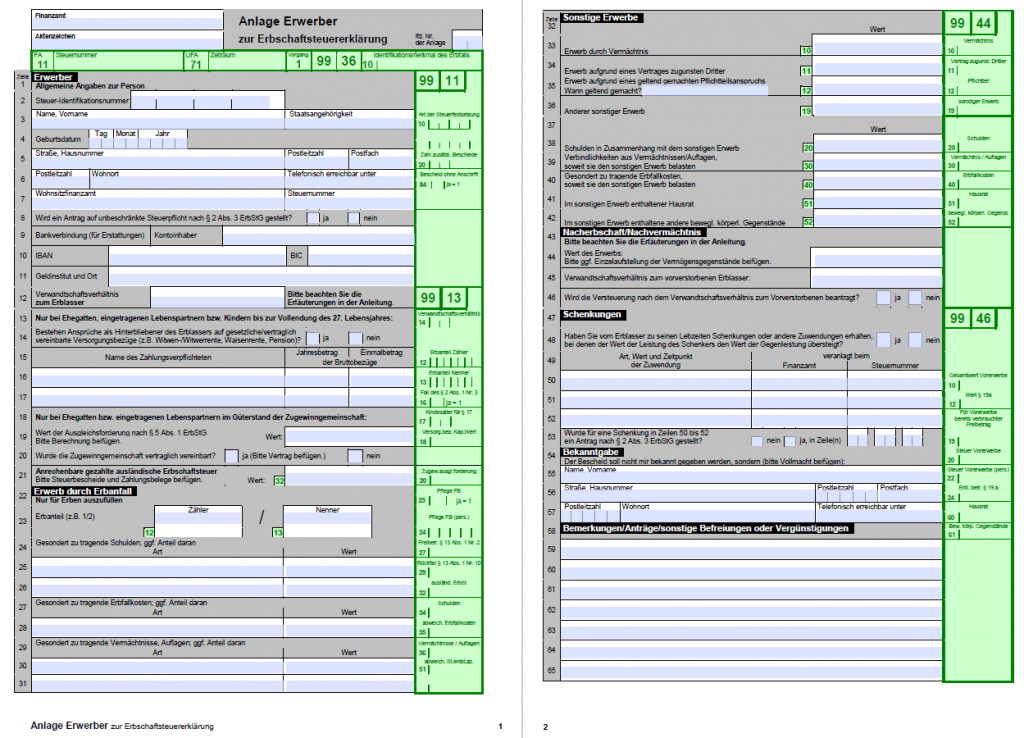

In addition to this main estate tax form, each beneficiary must submit their individual attachment (in German “Anlage Erwerber”) in which each beneficiary explains and confirms what they do receive from the estate.

Lifetime gifts (Schenkungen zu Lebzeiten) made by the deceased can also be relevant and can trigger additional German gift tax (Schenkungsteuer).

The layout of the various German estate and gift tax forms (Steuerformulare) may slightly differ from German state (Bundesland) to state but the questions asked are identical. For the state of Bavaria, the forms can be downloaded from the official tax office website here. The website also provides manuals and official explanatory notes on how to complete the respective tax forms, everything, however, only available in german language.

For more information on German-British probate matters and international will preparation see the below posts by the international succession law experts of Graf & Partners LLP:

- Most Germans die without a Will (German Intestacy Rules)

- The Perils of German IHT and Gift Tax

- Basics of German Inheritance and Succession Law

- Can foreign Taxes be set off against UK Inheritance Tax?

- Executors and Trustees in German Inheritance Law

- How to apply for a German Grant of Probate

- Germans Heirs are Personally Liable for Debts of the Deceased

- International Wills and Estate Planning for British-German Families

- Don’t be afraid of Clients with Foreign Assets!

- Or simply click on the “German Probate” section in the right column of this blog.

– – – –

The law firm Graf & Partners and its German-English litigation department GP Chambers was established in 2003 and has many years of experience with British-German and US-German probate matters, including the representation of clients in contentious probate matters. We are experts ininternational succession matters, probate and inheritance law. If you wish us to advise or represent you in a German or cross border inheritance case please contact German solicitor Bernhard Schmeilzl, LL.M. (Leicester) at +49 941 463 7070.