German Testators cannot fully disinherit their Children and their Spouse. Not even their Parents for that matter!

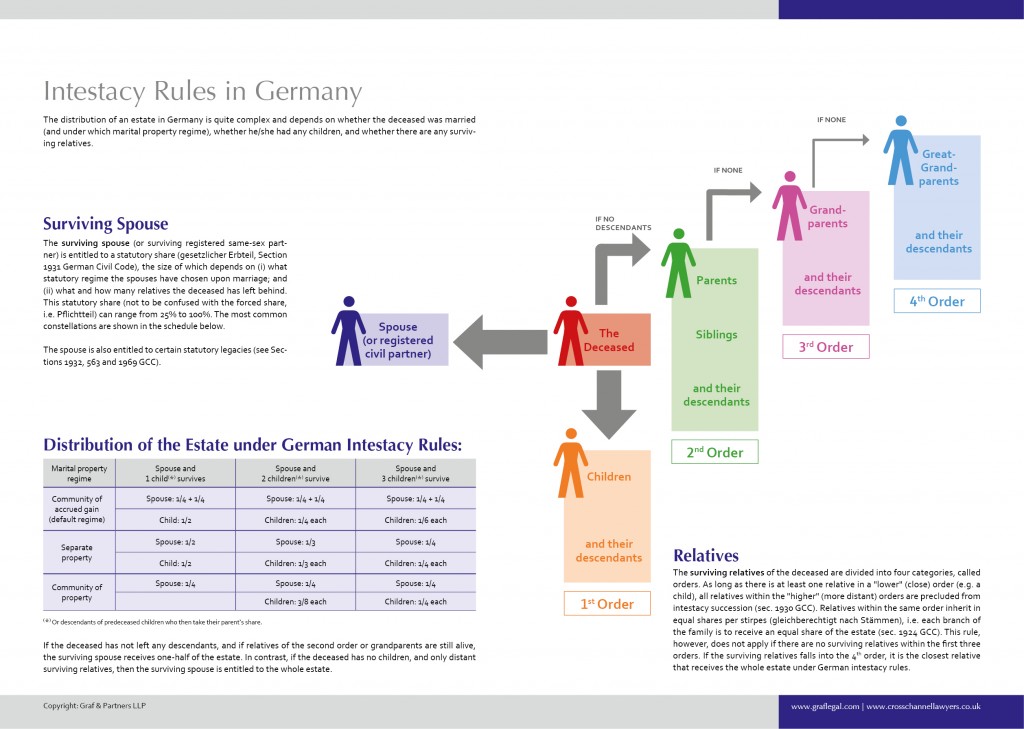

The German elective share is the statutory amount that a surviving spouse, descendant or parent may choose to take of the deceased’s estate as an alternative to what was provided (or rather: not provided) for him or her in the deceased spouse’s Last Will and Testament. Such election is not automatic and must be made within 3 years of gaining knowledge of having been disinherited (in practice, from issuing letters of administration, i.e. the German Erbschein). The Pflichtteil may be utilized if the Will leaves the spouse, child or parent less than he or she would otherwise receive by statute, i.e. German intestacy rules.

If a German testator wishes not to be bound by these elective share rules, he or she can agree with the spouse, child etc that they waive this right. However, such a elective share waiver agreement (Pflichtteilsverzichtsvertrag) is only valid if recorded by a German notary and it obviously requires some form of remuneration to motivate the relative to sign such waiver.

For more information on cross border probate matters, international will preparation and German inheritance tax matters see the below posts by the international succession law and tax law experts of German law firm Graf & Partners LLP:

- Brochure on German Probate and German Inheritance Tax (in English)

- Most Germans die without a Will (German Intestacy Rules)

- Does a German Last Will and Testament become void if the Testator later marries or has children?

- Formal Requirements to set up a valid Will in England, Scotland and Germany: What are the Differences?

- The Perils of German IHT and Gift Tax

- How to access German assets without going through Probate

- Careful with Deed of Variation if Estate comprises Foreign Assets

- Basics of German Inheritance and Succession Law

- Executors and Trustees in German Inheritance Law

- How to apply for a German Grant of Probate

- The Infamous German Community of Heirs – And how to avoid it

- Germans Heirs are Personally Liable for Debts of the Deceased

- International Wills and Estate Planning for British-German Families

- Prove German Wills for English Probate

- Disputed Wills and Contentious Probate in Germany

- Disinherit your no-good children? Not so easy in Germany

- Don’t be afraid of Clients with Foreign Assets!

- Can foreign Taxes be set off against UK Inheritance Tax?

Or simply click on the “German Probate” section in the right column of this blog.

The Anglo-German law firm Graf & Partners and its German-English litigation department GP Trial Lawyers was established in 2003 and has many years of experience with British-German and US-German probate and tax matters, including the representation of clients in contentious probate matters. We are experts ininternational succession matters, probate and inheritance law. If you wish us to advise or represent you in a German or cross border inheritance case please contact German solicitor Bernhard Schmeilzl, LL.M. (Leicester) at +49 941 463 7070.

[…] Then, finally, there is the infamous “Pflichtteil” (“forced share“, “elective share” or “compulsory share“) which the spouse and other close relatives can claim if they are disowned in a will. The details of this legal concept are explained here and here. […]

[…] especially those influenced by the French Civil Code (“Code Napoleon”), inter alia Germany, Austria, Italy and Spain. But also Islamic countries. An overview of this “Forced […]

[…] is that the inheritance laws of Germany, France and many other European countries do apply the concept of a statutory compulsory share (mandatory elective share), which means that certain close relatives (usually spouses, offspring and parents) are entitled to […]

[…] Under French law, a fixed proportion of the estate (of at least one half) is inherited by the child or children of the deceased, irrespective of the testator’s wishes as expressed in his or her will (“forced inheritance”). In Germany, the situation is similar: the surviving spouse, children and even the parents of the deceased are entitled to make a significant financial claim against the heir(s), the so called Pflichtteilsanspruch (details here). […]

[…] English will as such remains valid (see here). However, what English solicitors rarely know is that German forced share rules (Pflichtteil) do apply if the deceased had his or her last habitual residence in Germany — UNLESS the […]

[…] statute barred (section 2332 German Civil Code). More about the German elective share rules in this post and in our YouTube videos on German inheritance law https://youtu.be/gJTcyeiXPRw […]