German residents are subject to German inheritance tax. Always!

Many of our blogposts deal with German probate and the tax implications of international inheritance cases (see list below). English solicitors and their clients are often stunned by the fact that German assets which are part of an English estate can trigger significant German inheritance and/or gift tax, in addition to UK IHT. Vice versa, if a beneficiary happens to be resident in Germany (even if Germany is not the main place of residence), that person’s share in the estate is also subject to German gift and/or inheritance tax. Therefore, German inheritance tax is closer than a British solicitor may think.

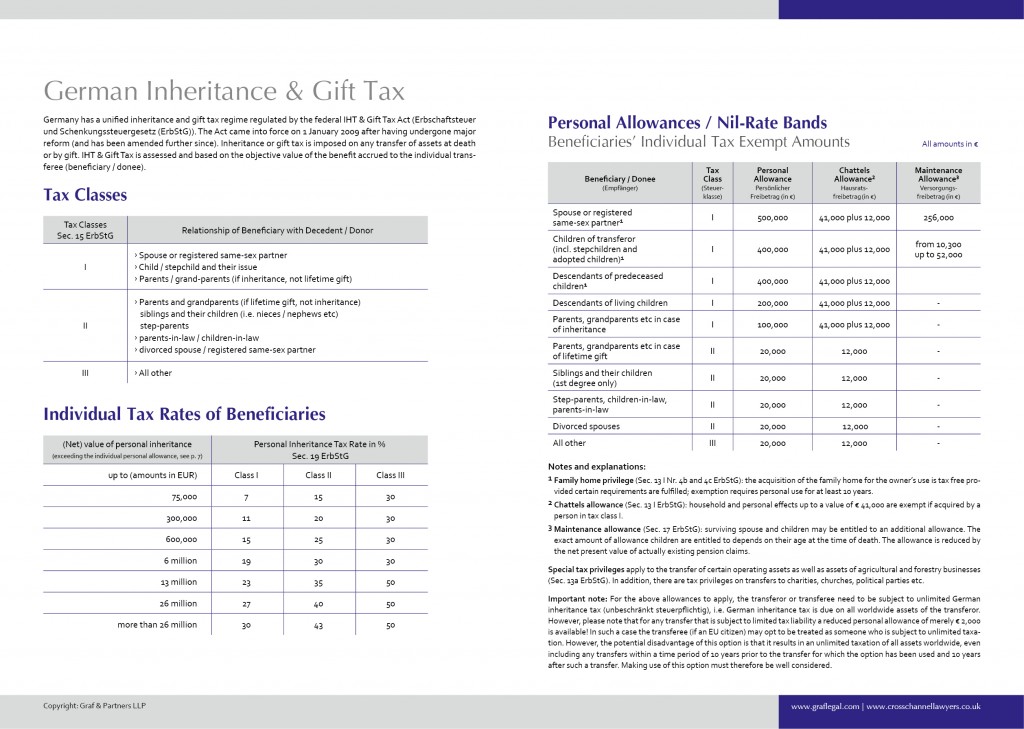

The below schedule shows at one glance the German IHT tax categories (tax classes), the individual tax rates and the various personal allowances and special tax exemptions available for certain assets. As you can see, the German inheritance tax system is much more complicated compared to British IHT. Depending on who the beneficiary is, the tax actually due can be significantly lower or higher than in the UK.

For more information on German-British probate matters and international will preparation see the below posts by the international succession law experts of Graf & Partners LLP:

- Most Germans die without a Will (German Intestacy Rules)

- Formal Requirements to set up a valid Will in England, Scotland and Germany: What are the Differences?

- The Perils of German IHT and Gift Tax

- Basics of German Inheritance and Succession Law

- Executors and Trustees in German Inheritance Law

- How to apply for a German Grant of Probate

- The Infamous German Community of Heirs – And how to avoid it

- Germans Heirs are Personally Liable for Debts of the Deceased

- International Wills and Estate Planning for British-German Families

- Prove German Wills for English Probate

- Disputed Wills and Contentious Probate in Germany

- Disinherit your no-good children? Not so easy in Germany

- Don’t be afraid of Clients with Foreign Assets!

- Can foreign Taxes be set off against UK Inheritance Tax?

Or simply click on the “German Probate” section in the right column of this blog.

The law firm Graf & Partners and its German-English litigation department GP Litigation Department was established in 2003 and has many years of experience with British-German and US-German probate matters, including the representation of clients in contentious probate matters. We are experts ininternational succession matters, probate and inheritance law. If you wish us to advise or represent you in a German or cross border inheritance case please contact German solicitor Bernhard Schmeilzl, LL.M. (Leicester) at +49 941 463 7070.

[…] between the parties, such a Deed of Variation does not retroactively alter the IHT situation, i.e. German IHT is always being based on the actual circumstances which had existed upon the moment of […]

[…] exempt amounts (usually 20,000 Euros) and must also pay higher tax rates than close family members (details in the table of German IHT rates here). So one cannot generally say whether an heir is better off according to German or UK inheritance […]

[…] Each beneficiary (heir, legatee or donee) is personally responsible for filing an inheritance tax declaration (Erbschafts-Steuererklärung) and for informing the authorities about the amount he/she has received (whether the money has actually been paid out already or not). Depending on the degree of blood relationship of the beneficiary to the legator the beneficiary has a personal tax exempt amount. These personal tax exempt amounts vary hugely: from 500,000 Euro for spouses and 400,000 per child, to only 20,000 Euros for people that are not closely related. Only the amount exceeding this tax exemption will be taxed at a rate which again depends on the personal relationship of the beneficiary to the legator, from 7% up to 50%. A detailed table of German inheritance tax rates and personal inheritance tax exemptions is available here: German Inheritance Tax Exemption and Tax Rates […]

[…] unsere Broschüre zum deutschen Erbschafts- und Schenkungssteuerrecht in englischer Sprache (hier ein Auszug) müssen wir dann wohl um eine Seite mit Berechnungsbeispielen […]