Nowhere to hide from the German Finanzamt

If the deceased held funds or owned property in Germany, the German Tax Office (Finanzamt) will find out about it and will – most likely – levy German inheritance tax, even if the deceased was not a German national and even if the deceased was not resident in Germany. We have explained the workings of the German Inheritance and Gift Tax Code (Erbschafts- und Schenkungssteuergesetz) here.

Executors are under the legal obligation to submit an inheritance tax declaration (Erbschaftssteuererklärung). The German IHT forms are available for download here.

But would the German tax office (Finanzamt) ever find out about the assets of the testator if the executor would – let’s say – forget to submit such a German IHT declaration? Yes, the tax authorities definitely will find out about such assets of the deceased. For numerous reasons:

In case of German property, all transactions and notifications to the German Land Registry must officially be made through a notary. The notary is obligated to send a copy of each such deed to the German tax authority.

In case of bank accounts or other financial investments, section 33 German Inheritance and Gift Tax Code (Erbschaftssteuer- und Schenkungssteuergesetz) obliges every German bank, insurance company or other financial service provider acting within Germany to proactively disclose the accounts to the German tax office as soon as they learn about the death of the account holder. This includes persons or institutions holding accounts in escrow or as fiduciaries. Furthermore, German banks must also disclose the accounts held by foreign subsidiaries. So if the deceased was, for instance, a client of Deutsche Bank in Frankfurt and he also had a bank account with the Deutsche Bank branch in Austria or the United Kingdom, these investments will also be fully disclosed to the German tax office. It was only recently confirmed by the European Court of Justice (C-522/14 of 14 April 2016) that section 33 German Inheritance Tax Code does not violate EU law.

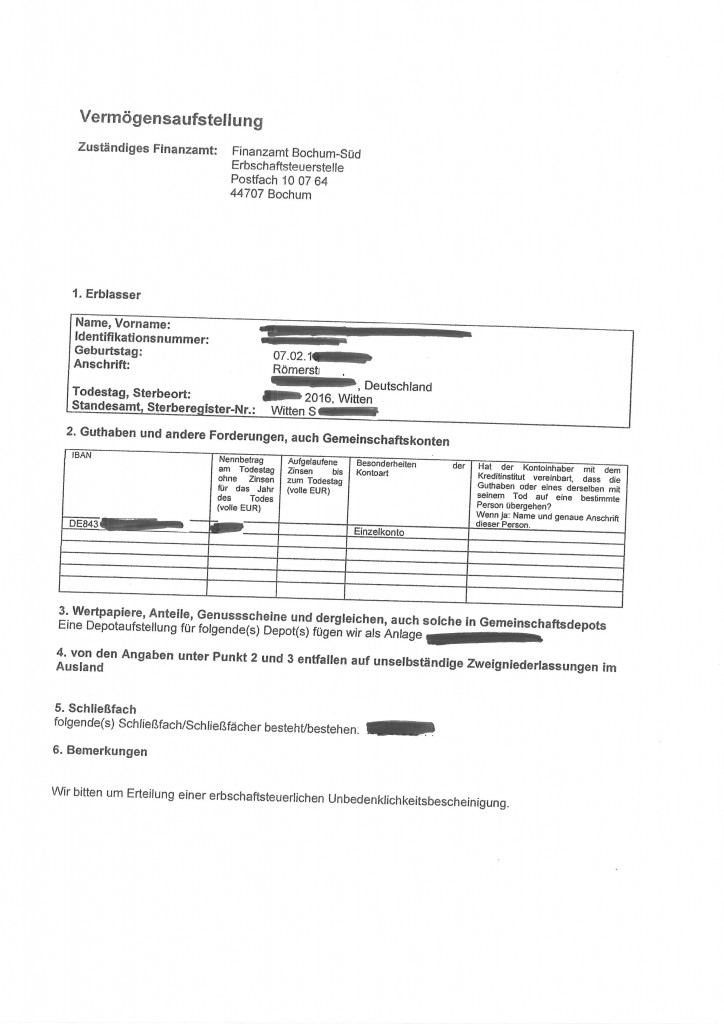

A German Bank’s Disclosure Notification of Decedent’s Assets to German Tax Authorities (Vermögensmeldung an das deutsche Finanzamt)

This is what the standard financial disclosure letter (Vermögensaufstellung) from the German bank to the German tax authorities looks like:

Finally, the executor and the beneficiaries are simply not able to access German funds, because banks etc will not release funds (except if there are unsignificant amounts or such amounts necessary to pay funeral costs) unless the executor can provide the so called steuerliche Unbedenklichkeitsbescheinigung (Certificate of Non-Objection) issued by the German tax authorities. More on this here.

So, if the deceased has held any assets in Germany, there is no way to avoid getting in contact with the German tax office. In the light of the above, one must be very careful not to omit any assets, because there is an extremely high risk that the tax office has already been informed about the deceased’s German bank accounts and other investments before the executor even submits the tax form. If the authorities get the impression that the executor is trying to hide something, the next letter will be from the German prosecutor’s office charging the executor with tax evasion.

For more information on German-British probate matters and international will preparation see the below posts by the international succession laws experts of Graf & Partners LLP

- The Perils of German IHT and Gift Tax

- How to apply for a German Grant of Probate

- International Wills and Estate Planning for British-German Families

- Prove German Wills for English Probate

- Disputed Wills and Contentious Probate in Germany

- Don’t be afraid of Clients with Foreign Assets!

- Can foreign Taxes be set off against UK Inheritance Tax?

Or simply click on the “German Probate” section in the right column of this blog.

In case you need specific advice in a concrete case or assistance in German probate procedures, feel free to contact the lawyers of the German firm Graf & Partners which are specialized in British-German succession issues. Attorney Bernhard Schmeilzl has years of experience acting as executor and administrator of estates, both in the UK and in Germany. He is an expert in international succesion law and gives lectures and seminars for UK probate solicitors and UK accountants who advise clients with foreign assets.

– – – –

The law firm Graf & Partners and its German-English litigation department GP Chambers was established in 2003 and has many years of experience with British-German and US-German probate matters, including the representation of clients in contentious probate matters. If you wish us to advise or represent you in a German or cross border inheritance case please contact German solicitor Bernhard Schmeilzl, LL.M. (Leicester) at +49 941 463 7070

[…] Wie ist es aber mit Auslandsvermögen? Kann man wenigstens riskieren, dass man Konten oder Beteiligungen “vergisst” abzugeben? Nun, auf keinen Fall sollte man darüber nachdenken, wenn es sich um eine Tochter eines deutschen Finanzinstituts handelt. Die sind nämlich ebenso zur Offenlegung verpflichtet. Erst kürzlich hat der Europäische Gerichtshof entschieden, dass § 33 ERbStG mit EU-Recht vereinbar ist (C-522/14 vom 14. April 2016). In anderen Ländern, insbesondere in Österreich und im Vereinigten Königreich (UK), gibt es vergleichbare Pflichten nicht, in den Steueroasen Jersey, Guernsey, Cayman Islands etc natürlich ohnehin nicht. Trotzdem ist es für Erben extrem riskant, Auslandsvermögen nicht anzugeben. Irgendwann muss es ja “gehoben” werden. Weitere Infos hier. […]